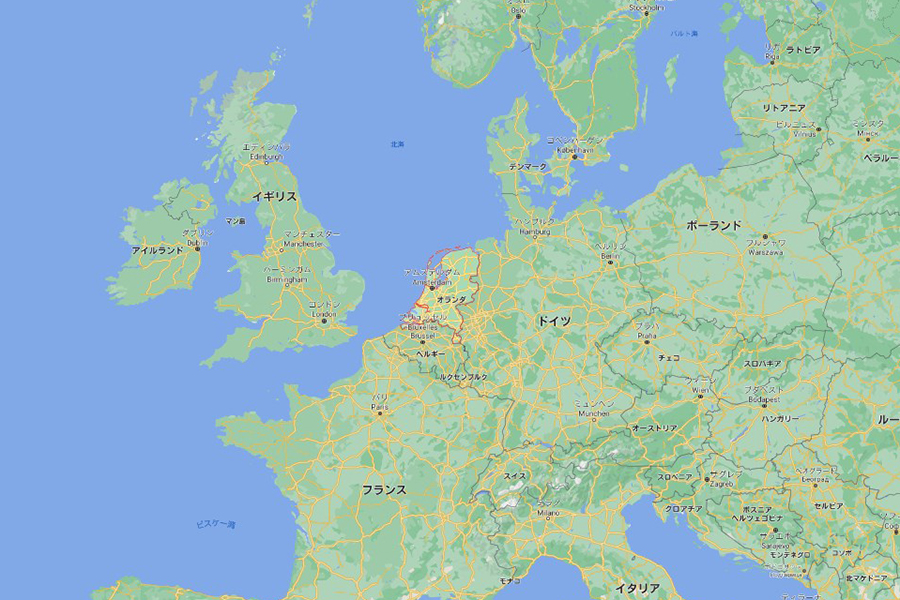

Netherlands

08/07/2021

01/03/2024

The Netherlands is popular with people who want to live in Europe as a freelancer because it is relatively easy for Japanese and Americans to get a visa.

For other countries, there is a scoring system

An important condition for obtaining a self-employed visa in the Netherlands is for the said business to be of essential interest to the Dutch economy. The products or services are assessed by the Netherlands Enterprise Agency based on a scoring system

There are three essential evaluation parts with a total value of 300 points. At least 90 points are needed for a favorable result for the Netherlands freelance visa, with a minimum of 30 for each sub-section. The three parts are the following:

- personal experience: the applicant’s education, entrepreneurship and work experience are taken into consideration

- business plan: the product or service, financing, price, organization and market analysis are relevant

added value for the country: the level of innovation of the said product or service, the number of jobs it can create, and the possible investments it can lead up to

In addition, after 5 years, it will be possible to obtain permanent residence.

Below, There are list some of the maximum points that may be awarded for different sub-categories:

- 25 points: the potential market for the product or service with a maximum of 10 points for its features, applications, potential customers, competition, risks or market promotion and a maximum of 5 points for clear product pricing

- 50 points: the maximum number of points for financing, with different scores according to issues like balance, turnover or liquidity forecast

- 20 points: the maximum point value that can be awarded for innovation

- 40 points: the maximum for the creation of labor, with different point values awarded according to the number of jobs that are created (a minimum of 10 points for 2 -<5 employees)

Documents Needed for Residence Permit

- Passport

- Proof of Income

- Degree of certification to prove you are a qualified professional

- Details about your business including the plan, financial aspects, market analysis, and legal aspects

- If you want to work as a freelancer, you will have to provide details of your work assignments from the employers with whom you will be working

- Proof of educational qualifications

- Experience details about working within the Netherlands, if any

- Application Fees:€ 1348

Income tax amount (2021)

General income (Box1) is the following tax amount

- 0~€35,129:9.45%

- €35,129~€68,507:37.10%

- €68,507~:49.50%

Income deduction

- Public transport charges

- House deductible costs

- Income reserves such as pension insurance premiums

- Dependent allowance and other maintenance obligations

- Expenses for specific medical expenses

- Temporary home for people with severe disabilities

- Research and other educational expenses

- Gift

- The rest of the personal allowance

General comment

After all, it is a big advantage that it is easy to get a visa in Europe

If you have permanent residence, you can live in another EU country (you can live in the EU for up to 6 years outside the Netherlands), so if you want to live elsewhere but it is difficult to get a visa, it will be a stepping stone.

The disadvantages are that prices are high, so it's hard if you don't have a decent income, and that taxes are high.

If you are not particular about the Netherlands, I think France is better.