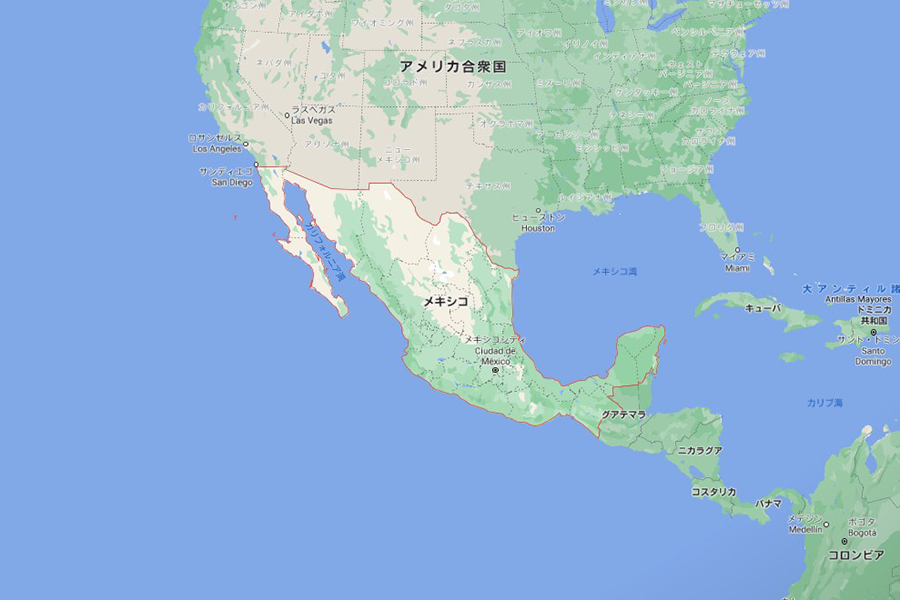

Mexico

07/30/2021

02/27/2023

Mexico is one of the hotspots of Nomads and is a country where you can easily get a temporary stay visa.

Temporary stay visas are usually valid for one year, but if the requirements are met, an additional three years will be added for a total of four years of long-term stay.

If you have lived for 4 years, you can apply for permanent residence.

If you have legally lived for 5 years, you can get citizenship

Mexico recognizes dual citizenship

Visa requirements

- OK if you have a monthly income of $ 1,620 or more or $ 27,000 in the last 6 months

- You must be hired by a remote company or a company outside Mexico and not work in Mexico.

How to apply

- Get NUT number

In order to apply for a visa at the Mexican Embassy, you will need a number called NUT (Número Único de Trámite) issued by the Instituto Nacional de Migración (INM).

Please contact INM in each state - Visa application reservation at the embassy

Once you have obtained your NUT number and are ready to apply, make a reservation on the online reservation site MEXITEL. - Apply for a visa

- Required documents are as follows

- Passport (1 copy of the original / photo page)

- A copy of the document from the Immigration Department with the NUT number

- Application form (Click here for how to write)

- 1 photo (length 4 cm x width 3 cm, white background, forehead and ears, no glasses)

- Obtaining a residence card

Temporary resident visa is valid for 180 days

It is mandatory to switch to a residence card at the Instituto Nacional de Migración (INM) in your area of residence within 30 days of entering Mexico.

personal income tax

Progressive taxation from 1.92% up to 35%

30% for about $ 27161 (MXP540,000)

Capital gains are treated as ordinary income, but gains from the sale of securities listed on the Mexican Stock Exchange are taxed at a 10% tax reduction rate.

Duty Free for Sale of Major Residential Real Estate

Dividends are subject to a 10% withholding tax, but corporate taxes paid may be tax deductible.

Dividends received from foreign entities are taxable and are subject to a 10% withholding tax.

Local governments collect property tax. Taxes paid may be deducted from your rental taxable income.

Transfer of real estate is subject to a transfer tax of 2% to 5%

No inheritance tax or net worth tax

VAT is 18%, but food and medicine are exempt

General comment

There aren't many long-term visas, up to 4 years from the beginning, so it's a lot easier to renew your visa.

It is close to the United States and may be good for those who move frequently, but the disadvantage is that the tax rate is higher than in other countries.