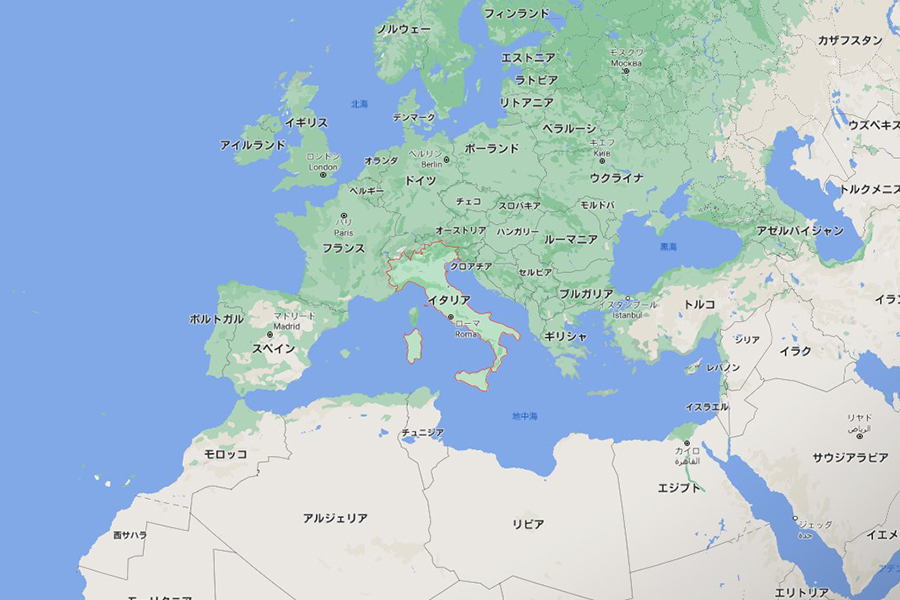

Italy

08/02/2021

05/04/2024

In Italy, which is popular in Japan, a "working visa for self-employed people" that allows the activities of sole proprietors (laptop workers, etc.) called dittaindividuale or freelancers (so-called professionals) called libero professionista Can be obtained

Apart from the sole proprietorship, you can also start a business with a startup visa.

Visas for Nomads are currently being considered for tax cuts of 70% of their income

Only for non-EU citizens, it is valid for 2 years from the issue date, and it can be extended when it expires.

To apply for this visa, you must make a reservation with the Italian embassy or consulate in your country of residence.

Various supporting documents will be required, such as proof of proper accommodation in Italy and proof of income.

Self-employed visa requirements

- Having a suitable residence in Italy

- Have financial resources higher than the legal exemption for national health services (currently at least € 8500)

- Acquisition of NULLA OSTA (work permit)

- Have the necessary certificates, documents, etc. for business activities in each field. Documents required vary by profession and applicants must meet all requirements when registering for a profession in Italy

The most difficult of these is getting NULLA OSTA.

This is because [when issuing a work permit, the number of annual issuances is set by the Italian government], so it seems difficult for individuals to pass it.

Nomad visa is expected because the threshold is likely to be lower

Registration of dittain dividuale

- Get VAT number

- Report tothe Internal Revenue Office

- Registered in the company register of the Chamber of Commerce

- Registered with INPS (National Institute of Population and Social Security Research) and INAIL (National Institute of Occupational Accident Insurance)

Personal income tax rate

Sole proprietors are subject to a 15% flat tax on income up to € 65,000

In that case, it will not be subject to additional local tax.

※There is usually a maximum of 3.33% local tax and 0.01-0.9% municipal tax.

Normal income tax rate is 0-43% progressive taxation

- 23% up to € 15,000

- 27% up to € 28,000

- 38% up to € 55,000

- 41% up to € 75,000

- 43% above that

Social security tax rate

- 34.23% of those who have additional DIS-COLL (unemployment allowance) collected

- 33.72% for those who do not

Deduction

Business expenses are deductible

Social security contributions will be € 1,104 up to € 4,800 and will decrease from there to € 55,000.

General comment

Italy is one of the countries I want to live in because of its great design, color scheme and curvaceous beauty.

A 15% flat tax is appreciated for incomes up to € 65,000, but above that it's a bit tough and you'll have to wait for Nomad Visa details.