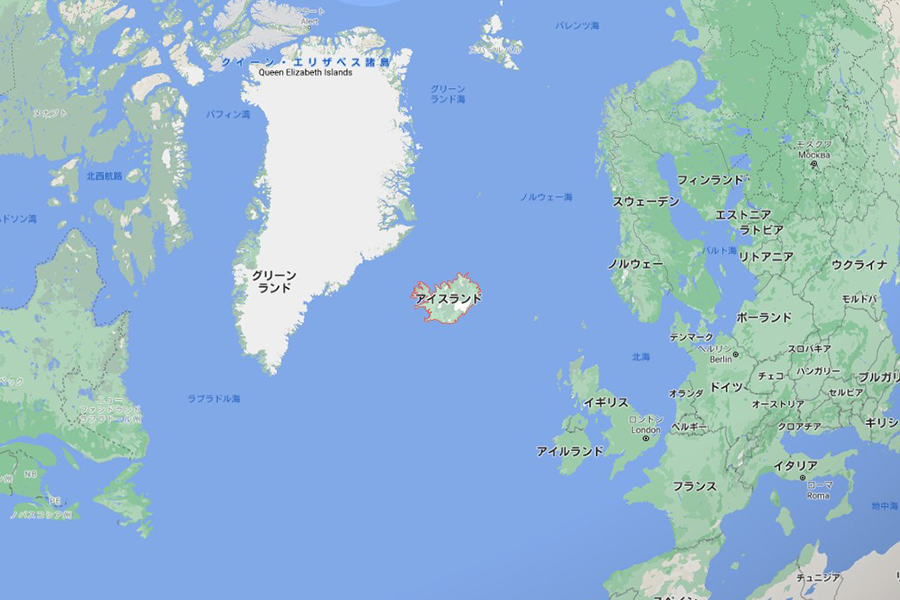

Iceland

08/01/2021

02/28/2023

Iceland also issues long-term stay visas, but unlike other countries, the deadline is 180 days.

Normally, Icelandic residents have a social security tax burden of 34.44% as income tax, but since they never exceed 183 days to become a tax resident, there is no income tax or social security tax burden.

Terms

- Citizens of countries other than EU / EEA / EFTA

- Have not been issued a long-term visa in Iceland within the last 12 months

- Doing remote work

- Those who do not stay in Iceland for a long time

- If you have a monthly income of ISK 1,000,000 (about $ 7800) or more and you want to apply for a spouse or a child under the age of 18, ISK 1,300,000 (about $ 10150) is required.

- Have health insurance that meets the requirements

- ISK 7,800 (approx. $ 60.90) per person as an application fee

What you need to apply

- Application Form-802

- Application fee (prepaid)

- A copy of your passport that is valid for at least 3 months

- Passport photo (35x45mm taken within the last 6 months)

- Health insurance covering Ireland

- In the case of an employer, confirmation from the employer that the applicant can work remotely

- In the case of self-employment, confirmation that the applicant can be confirmed to be self-employed in his / her own country or place of residence

- Income proof

ISK 1,000,000, or ISK 1,300,000 per month if you have a family - Police certificate

- Marriage certificate if you have a spouse

- Birth certificate etc. if you have children

※If your child is 6 to 16 years old, you will need one of the following as a document about your child's education:

〇Take distance lessons from your home school

〇Enrolled in an Icelandic school

〇Get homeschooled

General comment

Iceland provides magnificent nature and clean air, but it is a difficult country for many remote workers.

It is a big point that income tax is exempt (please check the tax agreement with the country of residence for tax purposes) because you will be a non-resident for tax purposes, but the VAT rate of 24% is very burdensome.

Another negative point is that you can only stay for 180 days.