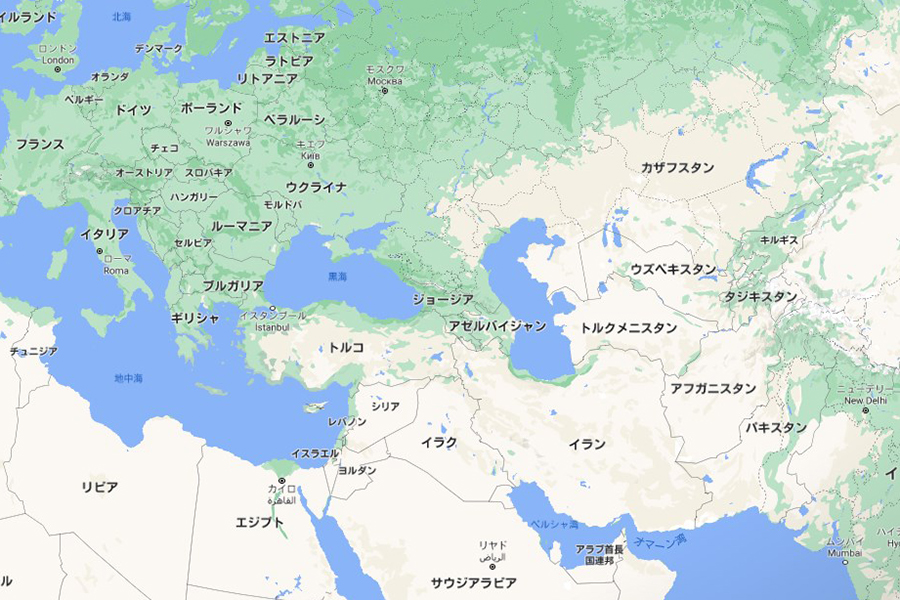

Georgia

07/28/2021

01/02/2024

Georgia is well known as a country where you can stay 360 days without a visa and work locally without special permission, but Special visa, Remotely from Georgia has been added

This allows you to stay as a remote worker for 180 to 360 days.

Georgia's income tax is 20%, but an annual income of 500,000 GEL (about $ 160000) is only taxed at 1%.(Application required)

You don't have to sign an accountant, just log in to a dedicated website and pay taxes on your previous month's income (no expense deductions) with your card.

Moreover, even if it exceeds 500,000 GEL, a low income tax of 3% will be applied.

The burden of social security, which is a blind spot in other countries, is 4% for residents (0% for non-residents), so considerable savings are possible.

Micro business status

No tax payment if annual sales in Georgia are less than 30,000 GEL (about $ 9615)

Micro businesses must declare and pay tax by the 31st of March in the year following the reporting year

Small business status

1% tax on total sales is required for annual sales in Georgia from 30,000 to less than 500,000 GEL

If you exceed 500,000 GEL, the tax rate will be 3%

There is no deduction, so it's a good system for jobs that are serviced on a PC

Small business income must be declared and paid by the 15th of each month

※If gross revenue (turnover) exceeds 500,000 GEL in 2 consecutive years, the small business status will be revoked

Notes

Georgia is taxed on the territory and income earned from abroad is tax exempt

A good percentage of people think that this is tax exempt if they work abroad remotely from Georgia.

For example, using a laptop to write a blog

But this is wrong

It is also a big factor that wrong information is introduced on many websites.

If you were working in Georgia, you will be taxed as it will be a Georgia source.

About application

Georgia automatically becomes a tax resident after 183 days of stay

This tax resident has a different meaning than the place of residence where you actually live.

If you want to know the difference, do a google search or contact me

The above tax rates will be applied from the month following the approval of the application, so it is recommended to apply as soon as possible.

Please note that status is not given automatically

If you do not apply, the tax rate will be as high as 20%.

Please read here for details

Application for temporary stay

- Submit your application online

- The minimum monthly income for the last 12 months must be $ 2,000, but some have been approved with a savings certificate of about $ 20,000.

- Requires a minimum of 6 months of health / travel insurance

- If you have a family member or partner, you can cover all of them with one application

There is a reply within 10 days, and even if it is approved, it is not necessary to enter the country immediately

Also, although the stay is at least 180 days, it is OK to leave the country on the way.

Cost

You can apply for free

Immigration requirements

- If you have a vaccination certificate, you can enter the country unconditionally.

- If you have not been vaccinated, you must have a negative PCR test certificate within 72 hours of entering Georgia.

- Have a PCR test at your own expense on the 3rd day after entering Georgia

Local insurance company

- GPI

Basic insurance is GEL10 (about $ 3) per month - IMEDI

Basic insurance is GEL12 (about $ 4) per month - UNISON

Basic insurance is GEL35 per month (about $ 11.22) - Ardi

I think the basic insurance is GEL33 (about $ 10.5) per month, but I can't proceed due to SMS problems. - EUROINS

There seems to be insurance, but I can't find the price list - ALPHA

I can't find the part of my personal health insurance

General comment

Low income tax is pretty attractive

Even if you establish a corporation, 20% income tax will not be levied until you pay dividends, so it is a high point that it is virtually tax exempt if you make internal reserves or reinvest.

Even if you can manage to some extent in English, you have to learn Georgian and you can not earn unless you establish a business model that deals with third countries

I think the negative point is that there are frequent water outages and power outages.